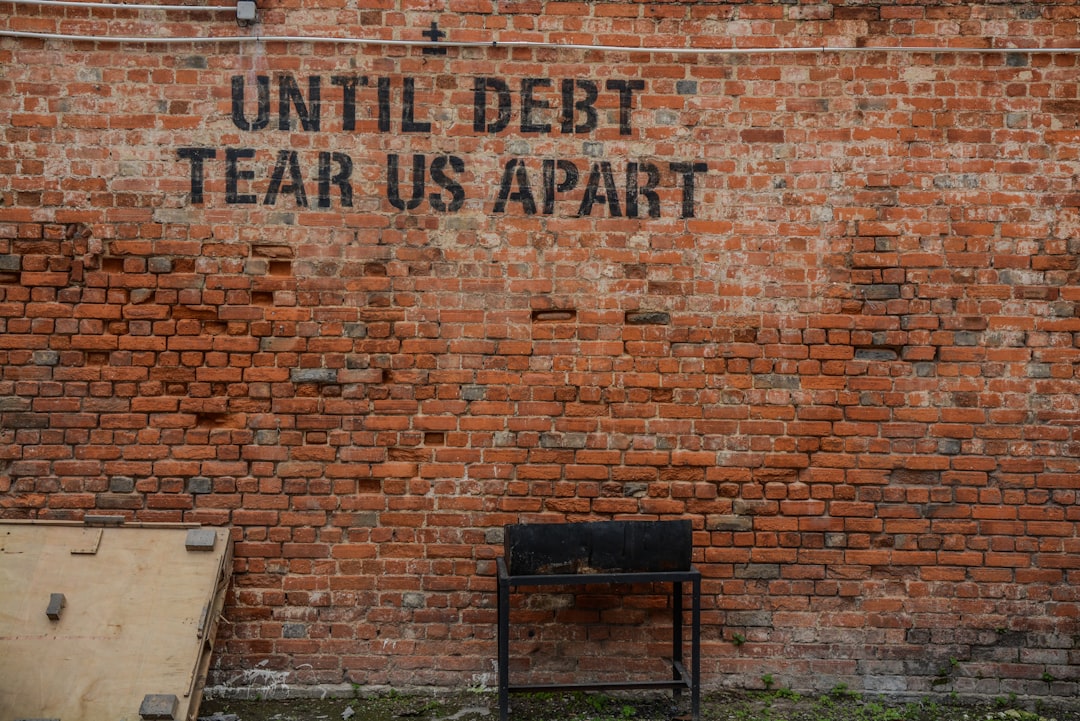

Combining finances is a significant step for any couple, but it becomes even more complex when re-marriage is involved. The financial implications and challenges that come with blending two households and families can be overwhelming. However, with proper planning and communication, it is possible to navigate these waters successfully. This ultimate guide aims to provide you with the tools and knowledge you need to blend your finances and create a solid financial foundation in your re-marriage. From addressing financial baggage to merging bank accounts and investments, this guide covers it all. So, if you’re about to embark on a re-marriage and want to ensure financial harmony, keep reading to discover the ultimate guide to successfully blending finances.

2. Understanding the importance of blending finances in a re-marriage

Blending finances in a re-marriage can often be a sensitive and challenging topic for many couples. However, when done with careful planning and consideration, it can offer several important benefits. Understanding these benefits can help couples navigate the complexities of combining their financial lives and create a solid foundation in their re-marriage.

1. Transparency and Trust: Blending finances requires open and honest conversations about money. By sharing financial information, such as income, debts, and expenses, couples can establish transparency and build trust. This level of transparency allows both partners to have a clear understanding of each other’s financial situation, which is vital for making joint financial decisions.

2. Financial Security: Combining finances provides a sense of security for both partners. It allows for a shared responsibility in managing household expenses, saving for the future, and planning for retirement. By pooling resources and leveraging each other’s strengths, couples can work together to achieve their financial goals more effectively.

3. Streamlined Financial Management: Blending finances simplifies the management of household finances. Instead of juggling multiple bank accounts, credit cards, and bills, couples can consolidate their accounts and streamline their financial responsibilities. This not only reduces administrative burdens but also minimizes the chances of missed payments or financial discrepancies.

4. Building a Strong Foundation: Blending finances in a re-marriage signals a commitment to building a shared future. It symbolizes a willingness to work together as a team, especially when it comes to financial matters that often impact various aspects of married life. By combining resources and aligning financial goals, couples can lay the groundwork for a strong and stable relationship.

5. Financial Equality and Fairness: Combining finances ensures that both partners contribute proportionately to the household expenses. It eliminates any potential power imbalances that may arise when one partner earns significantly more than the other. This promotes financial equality and fairness within the relationship, fostering a sense of partnership and mutual respect.

Blending finances in a re-marriage can be a complex process, but understanding the benefits it offers can motivate couples to tackle any financial challenges together. By prioritizing open communication, trust, and shared financial goals, couples can create a solid financial foundation that supports their re-marriage and strengthens their bond.

3. Communication is key: Discussing financial goals and concerns

Blending finances in a re-marriage requires open and honest communication about financial goals and concerns. This crucial step allows couples to align their expectations, establish a shared vision for their financial future, and address any potential challenges or differences in financial habits or attitudes. Here are some key points to consider when discussing financial goals and concerns:

1. Set aside dedicated time for financial conversations: Schedule regular meetings to discuss your financial goals, concerns, and progress. Having these conversations in a calm and dedicated setting can help avoid misunderstandings and ensure that both partners have the opportunity to be heard.

2. Share your individual financial histories: Be open about your past financial experiences, including any debts, financial mistakes, or positive habits. Understanding each other’s financial history can provide valuable insights into each partner’s approach to money management and help build empathy and understanding.

3. Define shared financial goals: Discuss and prioritize your joint financial goals, such as saving for a house, planning for retirement, or paying off debt. Setting clear objectives can help both partners stay motivated and focused on achieving common financial milestones.

4. Identify individual financial goals: While shared financial goals are important, it is also essential to acknowledge and respect each partner’s individual aspirations. Discuss how you can support and balance both joint and personal financial goals to ensure a sense of autonomy and fulfillment.

5. Establish a budget together: Create a joint budget that reflects your combined income, expenses, and financial priorities. Be prepared to compromise and make adjustments as needed to accommodate both partners’ needs and aspirations. Regularly review and update the budget to ensure it remains aligned with your evolving financial goals.

6. Address concerns and potential conflicts: Be proactive in discussing any concerns, worries, or potential conflicts surrounding finances. Whether it’s differences in spending habits, risk tolerance, or attitudes towards debt, addressing these issues early on can help prevent future misunderstandings or disagreements.

7. Seek professional guidance if needed: If you and your partner are facing complex financial situations or challenges, consider seeking the advice of a financial planner or counselor. These professionals can provide objective insights, facilitate productive discussions, and help you navigate any financial hurdles more effectively.

Remember, open and honest communication is the foundation of successful financial blending in a re-marriage. By creating a safe and non-judgmental space to discuss financial goals and concerns, couples can cultivate a sense of trust, mutual respect, and shared responsibility, leading to a stronger and more fulfilling financial partnership.

4. Evaluating and merging financial assets

Blending finances in a re-marriage involves the evaluation and merging of financial assets from both partners. This process can be complex and requires careful consideration to ensure a smooth transition and effective management of shared resources. Here are some key steps to follow when evaluating and merging financial assets:

1. Take stock of individual assets: Begin by assessing the financial assets that each partner brings into the re-marriage. This includes bank accounts, investments, retirement accounts, real estate properties, and any other significant assets. It is essential to have a clear understanding of your financial starting point before moving forward.

2. Understand legal implications: Consult with a legal professional to understand the legal implications of merging financial assets in your specific jurisdiction. Different regions may have different laws regarding the division of assets, prenuptial agreements, and other relevant financial considerations. By seeking legal advice, you can ensure that you are making informed decisions and protecting your rights and interests.

3. Determine joint and individual accounts: Decide on the structure of your new financial system. This may involve maintaining separate individual accounts, opening joint accounts, or a combination of both. Consider factors such as individual spending habits, financial responsibilities, and personal preferences. Open and honest communication is crucial during this process to establish a system that works for both partners.

4. Consolidate and streamline accounts: Once you have determined the structure of your accounts, start the process of consolidating and streamlining your financial resources. This may involve closing individual accounts, transferring funds, or adding each other as authorized users on existing accounts. Streamlining your accounts will make it easier to track and manage your finances as a couple.

5. Address debts and liabilities: Discuss and address any outstanding debts or liabilities that each partner may have. This includes credit card debt, loans, mortgages, or any other financial obligations. Develop a plan to pay off these debts together and establish a strategy for managing future debts as a couple.

6. Create a joint budget: Develop a comprehensive budget that incorporates both partners’ incomes, expenses, and financial goals. This budget should reflect your combined financial situation and outline how you plan to allocate funds for various expenses, savings, and investments. Regularly review and update the budget to ensure that it remains aligned with your evolving financial needs and goals.

7. Seek professional guidance if necessary: Financial blending in a re-marriage can be a complex process, especially if you have significant assets or complicated financial situations. Consider consulting with a financial advisor or planner who specializes in working with blended families. They can provide valuable insights, guidance, and objective advice to help you make informed financial decisions.

Blending financial assets in a re-marriage requires thoughtful planning, open communication, and a shared commitment to building a solid financial foundation as a couple. By following these steps and seeking professional guidance when needed, you can navigate the complexities of managing shared resources and work towards a financially secure and harmonious future together.

5. Creating a joint budget and managing expenses

Creating a joint budget and effectively managing expenses is a crucial step in successfully blending finances when getting re-married. A well-planned budget allows both partners to maintain financial stability, work towards shared goals, and avoid conflicts over money. Here are some key steps to help you create a joint budget and manage expenses:

1. Combine Income and Expenses: Start by combining both partners’ incomes and listing all shared expenses. This includes monthly bills, rent or mortgage payments, insurance premiums, transportation costs, groceries, and any other necessary expenses. It is important to have a comprehensive understanding of your collective financial obligations.

2. Discuss Financial Goals: Sit down together and discuss your short-term and long-term financial goals. This may include saving for a vacation, buying a house, paying off debt, or planning for retirement. By aligning your goals, you can create a budget that supports your shared financial aspirations.

3. Set Priorities: Determine your financial priorities as a couple. Consider which expenses are essential and non-negotiable, and which ones can be adjusted or minimized. This will help you allocate your income effectively and ensure that money is spent in line with your priorities.

4. Allocate Funds: Based on your combined income and expenses, allocate funds to different categories in your budget. This may include setting aside money for savings, emergencies, debt repayments, and discretionary spending. Be realistic and flexible with your allocations to accommodate unexpected expenses or changes in financial circumstances.

5. Track and Monitor Expenses: Regularly track your expenses to ensure that you are staying within your budget. Utilize budgeting apps, spreadsheet tools, or online platforms to record your spending and monitor your progress. This will help you identify areas where you may need to adjust your spending habits and make necessary changes.

6. Communication and Compromise: Maintaining open and honest communication about money is essential in a re-marriage. Regularly discuss financial decisions, upcoming expenses, and any changes in income or expenses. Be willing to compromise and find mutually beneficial solutions to any financial challenges that arise.

7. Regularly Review Your Budget: Schedule regular budget reviews to assess your financial progress and make any necessary adjustments. This could be done monthly, quarterly, or annually, depending on your financial situation and preference. Use these reviews as an opportunity to celebrate achievements, discuss challenges, and set new goals.

8. Seek Professional Assistance: If you are finding it difficult to create or manage your joint budget, consider seeking assistance from a financial advisor. They can provide expert guidance, help you optimize your budget, and offer personalized advice based on your unique financial circumstances.

Remember, managing finances as a couple requires teamwork, compromise, and open communication. By creating a joint budget and managing expenses effectively, you can build a strong financial foundation for your re-marriage and work towards a prosperous future together.

6. Tackling debts and financial obligations together

When blending finances in a re-marriage, it is essential to address any existing debts and financial obligations as a team. By working together to tackle these challenges, you can alleviate financial stress and set a solid foundation for your future as a couple. Here are some steps to help you effectively manage debts and financial obligations:

1. Assess Existing Debts: Start by making a comprehensive list of all debts that both partners bring into the re-marriage. This includes credit card debt, student loans, car loans, mortgages, and any other outstanding balances. Take note of interest rates, payment schedules, and minimum monthly payments for each debt.

2. Open Communication: Sit down together and have an open and honest discussion about your debts. This includes sharing any concerns, fears, or uncertainties. It is important to approach this conversation with understanding and empathy, creating a safe space to address any financial challenges and find solutions together.

3. Prioritize and Develop a Repayment Plan: Determine which debts carry the highest interest rates or pose the biggest financial burden. These should be given priority in your repayment plan. Consider using the debt avalanche or debt snowball method to tackle your debts strategically, paying off high-interest debts first or starting with smaller debts for quick wins and motivation.

4. Create a Joint Budget: As mentioned in the previous section, create a joint budget that incorporates your debt repayment plan. Allocate a specific amount each month towards debt payments and factor this into your overall financial plan. Be realistic when setting these amounts to ensure that you can comfortably meet your other financial obligations as well.

5. Explore Debt Consolidation Options: Debt consolidation can be a helpful tool for simplifying your repayment process. This involves combining multiple debts into one loan with a lower interest rate or more favorable terms. Consolidating your debts can make it easier to manage your payments and potentially save money on interest.

6. Seek Professional Guidance: If you are feeling overwhelmed or unsure about how to effectively manage your debts, consider seeking assistance from a financial advisor or credit counselor. These professionals can provide expert advice, help you negotiate repayment terms with creditors, and guide you towards sound financial decisions.

7. Maintain Open Communication: Throughout the debt repayment process, it is crucial to maintain open communication regarding your progress, challenges, and any changes in your financial circumstances. Regularly discuss your goals, celebrate milestones, and address any deviations from your repayment plan. This will help you stay accountable and work together towards becoming debt-free.

8. Adjust and Adapt as Needed: Financial circumstances may change over time, and it is important to reassess your debt repayment plan periodically. Factors such as changes in income, unexpected expenses, or new financial obligations may require adjustments to your strategy. Stay flexible and be willing to adapt your plan as needed to stay on track towards your debt-free goals.

By tackling debts and financial obligations together, you and your partner can overcome financial challenges and build a stronger and more secure future. With open communication, a clear repayment plan, and a commitment to working as a team, you can successfully manage your debts and create a solid financial foundation in your re-marriage.

7. Protecting your assets: Estate planning and insurance considerations

When entering into a re-marriage and blending finances, it is crucial to address the protection of your assets. This includes considering estate planning and insurance options to ensure that both you and your partner are financially secure in the event of unexpected circumstances. Here are some important considerations:

1. Update your estate plan: Review and update your existing estate plan to reflect your new marital status and blended family. This includes updating beneficiaries on your will, trusts, and life insurance policies to ensure that your assets are distributed according to your wishes. Consider seeking guidance from an estate planning attorney to ensure that your estate plan aligns with your goals and is legally sound.

2. Create or update your will: If you haven’t already, create a will or update your existing will to reflect your new circumstances. Clearly outline how your assets should be distributed after your passing, taking into account your new spouse, children from previous marriages, and any additional dependents. A will helps prevent uncertainties and potential conflicts among family members.

3. Consider a prenuptial or postnuptial agreement: In some cases, couples may choose to enter into a prenuptial or postnuptial agreement to protect their individual assets. These legal agreements outline how assets will be divided in the event of divorce or death, providing clarity and reducing potential disputes. Consult with a family law attorney to determine if a prenuptial or postnuptial agreement is appropriate for your situation.

4. Review and update insurance coverage: Assess your insurance policies, including life insurance, health insurance, and disability insurance, to ensure that you and your new spouse have adequate coverage. Consider combining policies or adding each other as beneficiaries to provide financial protection in the event of unexpected circumstances. Consult with an insurance professional to discuss your options and determine the appropriate coverage for your needs.

5. Consider long-term care insurance: As you plan for your future together, consider the potential need for long-term care insurance. This type of insurance helps cover the cost of care in the event that one or both partners require assistance with daily activities due to aging, illness, or disability. Long-term care insurance can help protect your assets and provide access to quality care when needed.

6. Consult a financial advisor: To ensure comprehensive protection of your assets, consider consulting a financial advisor who specializes in working with blended families. They can help you navigate complex financial considerations, provide guidance on tax-efficient strategies, and help you create a long-term financial plan that aligns with your goals.

7. Regularly review and update your plan: Life is constantly changing, and it is important to regularly review and update your estate plan and insurance coverage to reflect any significant life events or changes in your financial situation. Set aside time to revisit these considerations on an annual basis or whenever major life changes occur, such as the birth of a child, a change in employment, or the purchase of significant assets.

By taking proactive steps to protect your assets through estate planning and insurance considerations, you can ensure that both you and your new spouse are financially secure and that your assets are handled according to your wishes. Seeking professional guidance and regularly reviewing your plan will help you adapt to changing circumstances and maintain a solid financial foundation in your re-marriage.

8. Seeking professional guidance: Financial advisors and marriage counselors

Blending finances when getting re-married can bring about unique challenges and complexities. To navigate these complexities and ensure a smooth transition, it can be beneficial to seek professional guidance from both financial advisors and marriage counselors. Here is how these professionals can help:

Financial Advisors:

1. Comprehensive Financial Planning: Financial advisors specializing in working with blended families can help you develop a comprehensive financial plan that takes into account your individual financial goals, as well as the goals and needs of your new spouse and any children from previous marriages. They can assist in creating a budget, managing debt, and planning for long-term financial security.

2. Tax-Efficient Strategies: A financial advisor can help you navigate the tax implications of blending your finances, such as determining the most beneficial way to file taxes and exploring tax-efficient investment strategies. They can also assist in addressing any potential tax consequences that may arise from transferring assets or updating beneficiaries.

3. Asset Allocation and Investment Management: With a better understanding of your financial goals and risk tolerance, a financial advisor can guide you in determining the appropriate asset allocation for your investment portfolio. They can help you choose investments that align with your long-term goals and manage your portfolio to maximize returns while minimizing risk.

4. Retirement Planning: Blending finances often requires reevaluating your retirement plans. A financial advisor can assist in determining the impact on your retirement goals and help you make any necessary adjustments to ensure your financial future remains secure. They can also help you explore options like retirement savings accounts and pensions.

Marriage Counselors:

1. Communication and Conflict Resolution: Marriage counselors are skilled in helping couples navigate difficult conversations and resolve conflicts. They can assist in fostering open and effective communication about financial matters, which is crucial for a successful financial partnership. They can also provide tools and techniques to address any disagreements or differences in financial values and help create a shared vision for your financial future.

2. Establishing Shared Financial Goals: Building a strong foundation for your financial future requires aligning your goals and aspirations. A marriage counselor can help facilitate discussions and guide you in establishing shared financial goals that reflect the needs and desires of both partners. They can also assist in creating a plan to achieve those goals together.

3. Addressing Power Dynamics: Blending finances can sometimes introduce power imbalances into a relationship. A marriage counselor can help identify and address any underlying issues related to control or decision-making, ensuring that both partners feel respected and empowered in the financial decision-making process.

4. Managing Emotional Stress: Combining finances can evoke emotions and anxieties that may require professional guidance to navigate. A marriage counselor can provide a supportive environment to explore these emotions, offer coping strategies, and help you and your partner work through any emotional challenges that arise during this process.

Seeking guidance from financial advisors and marriage counselors can provide valuable support and expertise as you navigate the journey of blending finances in your re-marriage. Their guidance and advice can help you address potential challenges, build a solid financial foundation, and foster a healthy and fulfilling relationship with your new spouse. Remember, this professional guidance is an investment in your future happiness and financial well-being.

9. Nurturing open and honest communication for long-term financial harmony

Blending finances when getting re-married can be a complex and sensitive process. One of the key factors in ensuring long-term financial harmony is nurturing open and honest communication with your new spouse. Here are some tips for fostering effective communication about money matters:

1. Create a Safe and Judgment-Free Space: Money can be a sensitive topic, and individuals may have different beliefs, values, and experiences when it comes to finances. It’s crucial to establish a safe and judgment-free space where both partners feel comfortable discussing their financial situations, goals, and concerns.

2. Schedule Regular Money Talks: Set aside dedicated time to have regular conversations about your financial situation as a couple. This can be weekly, bi-weekly, or monthly, depending on your preferences and needs. Use this time to discuss budgeting, financial goals, upcoming expenses, and any other financial matters that need attention.

3. Be Transparent About Your Financial History: It’s important to be open and honest about your individual financial history, including any debts, investments, or assets you bring into the relationship. Transparency builds trust and enables both partners to make informed decisions about their joint financial future.

4. Establish Shared Financial Goals: Take the time to discuss and establish shared financial goals that align with both partners’ aspirations and values. This can include short-term goals such as saving for a vacation or a down payment on a house, as well as long-term goals such as retirement planning. Set clear objectives and work together to create a plan for achieving them.

5. Assign Roles and Responsibilities: Determine how you will handle day-to-day financial tasks and responsibilities. This includes tasks such as bill payments, budgeting, and tracking expenses. Assigning roles can help prevent misunderstandings and ensure that both partners are actively involved in managing their finances.

6. Develop a Budget Together: Create a budget that reflects your shared financial goals and priorities. Involve both partners in the budgeting process, making sure to consider each person’s needs and desires. Regularly review and update your budget as your circumstances change.

7. Discuss Your Financial Values: Money can be tied to deeply-held values and beliefs. Take the time to understand each other’s financial values and priorities. Discuss topics such as saving, spending habits, and financial independence. Finding common ground and compromise can foster mutual understanding and prevent conflicts in the future.

8. Seek Professional Guidance if Needed: If you encounter challenges or disagreements in managing your finances as a couple, consider seeking professional guidance from a financial advisor or marriage counselor. They can provide objective insights, help mediate discussions, and offer strategies for resolving conflicts.

Remember, nurturing open and honest communication about money is an ongoing process. Regularly check in with each other, listen actively, and be mindful of each other’s perspectives. By prioritizing effective communication, you can build a strong foundation for long-term financial harmony in your re-marriage.

10. Conclusion: Building a strong financial foundation for a successful re-marriage

Blending finances when getting re-married is a complex process, but by nurturing open and honest communication, you can build a strong financial foundation for a successful re-marriage. Throughout this guide, we have explored various tips and strategies to help you navigate the financial aspects of your blended family.

From creating a safe and judgment-free space for discussing money matters to scheduling regular money talks, these practices will encourage effective communication and ensure that both partners feel heard and understood. Transparency about individual financial histories, establishing shared financial goals, and assigning roles and responsibilities are all crucial steps in building trust and actively managing your finances together.

Developing a budget that reflects your shared financial goals and priorities, discussing your financial values, and seeking professional guidance if needed are additional strategies to promote financial harmony in your re-marriage. Remember, nurturing open and honest communication about money is an ongoing process. Regular check-ins, active listening, and mutual respect for each other’s perspectives are essential in maintaining a strong financial foundation.

By following these guidelines and investing time and effort into your financial conversations, you can create a solid groundwork for long-term financial harmony in your re-marriage. As you embark on this new chapter of your lives together, may your shared financial journey be filled with understanding, compromise, and a shared vision for a prosperous future.