Also referred to as a conservator or protector. A guardian is named to serve for the benefit of a minor …

The Role of the Power of Attorney

No one likes to consider the possibility of becoming mentally incapacitated due to age, accident or illness, but the fact …

What is The Role of the executor

An executor ties up personal and/or business affairs after someone passes away. The executor may also be referred to as …

Being A Caregiver

The most important thing to know about caregiving is that you do not need to do it alone. Getting support …

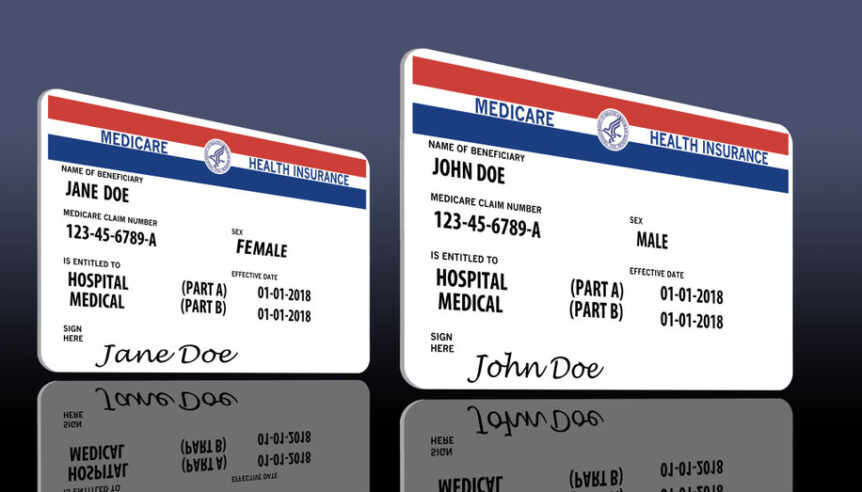

Facing the Complexities of Medicare

Understanding the basics of Medicare A, B and D will help you take necessary steps on schedule. It will also …

The Gift Tax? Questions of Life or Death

The Tax Cuts and Jobs Act raised the lifetime exclusion limits for estate and gift taxes from roughly $5.5 million …

Don’t Discount Your Will

A self-created last will and testament may lead to problems. As an early step in estate planning, you may be …

Missteps That May Negatively Impact Estate Plans

Inattention and procrastination can hurt family wealth. Some estate planning is better than none, but sometimes people address wealth transfer …

Potential Income Streams for Retired Women

Could you possibly arrange multiple income sources? On average, women receive 23% less Social Security income than men. In 2014 …

THE DEVIL IS IN THE DETAILS

An ex-wife as a primary beneficiary. Lapsed stock options. No medical power of attorney. What is in common with these …